PropNex Picks

|October 30,2025ABSD Navigator for Married Upgraders

Share this article:

Upgrading your home isn't just about picking the right neighbourhood or debating how big a unit you're going to need, it's also about timing. If you're not careful, you might fall victim to ABSD mis-sequencing. Plenty of couples have learnt this the hard way. One wrong step and you may end up paying a 6-figure ABSD that you could have avoided.

That's why we made this guide. So if you're a married couple thinking of upgrading, you might want to stick around til the end.

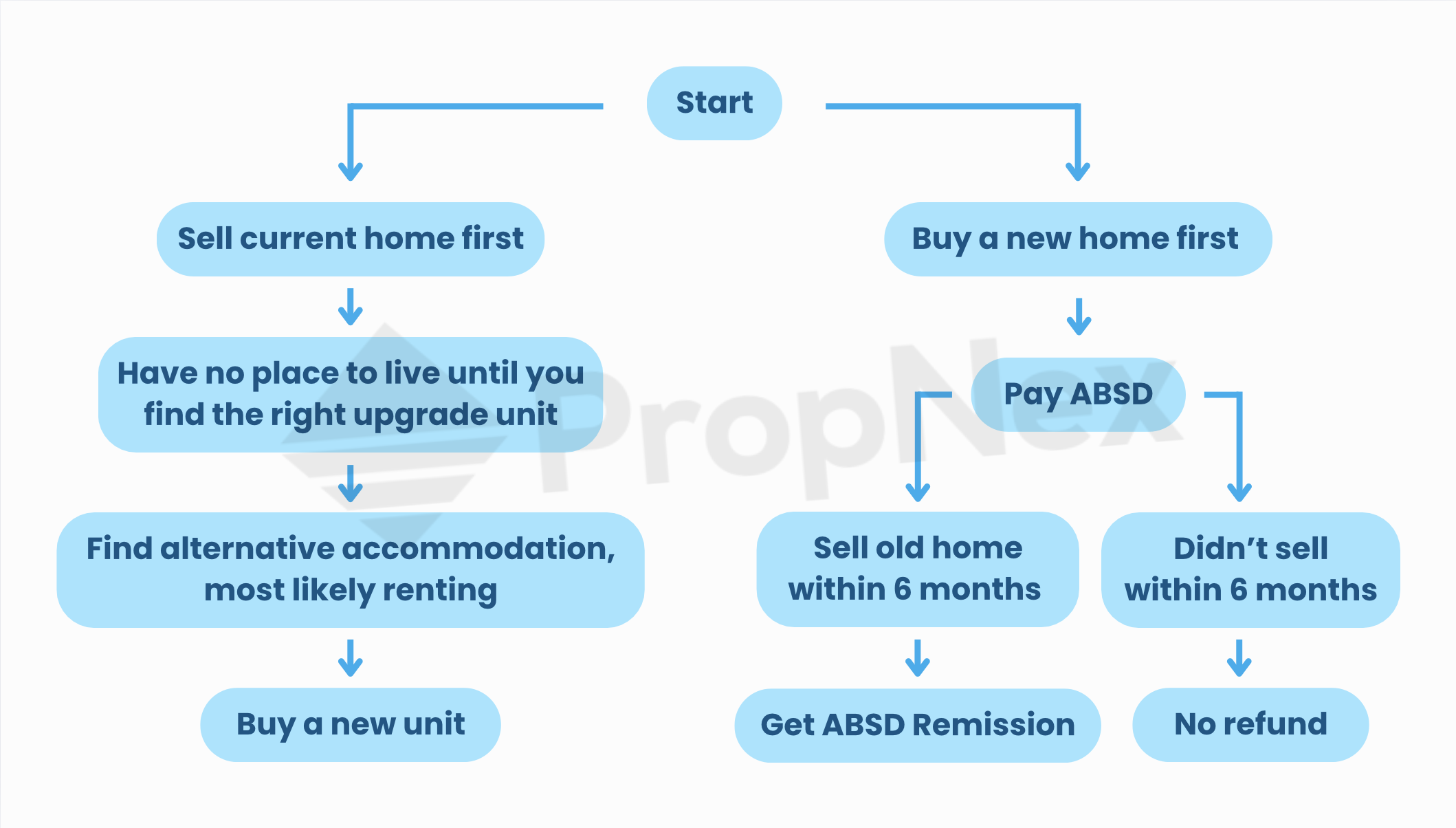

When you hear agents talk about "ABSD sequencing," they're really talking about the order in which you sell and buy your properties. The sequence makes all the difference.

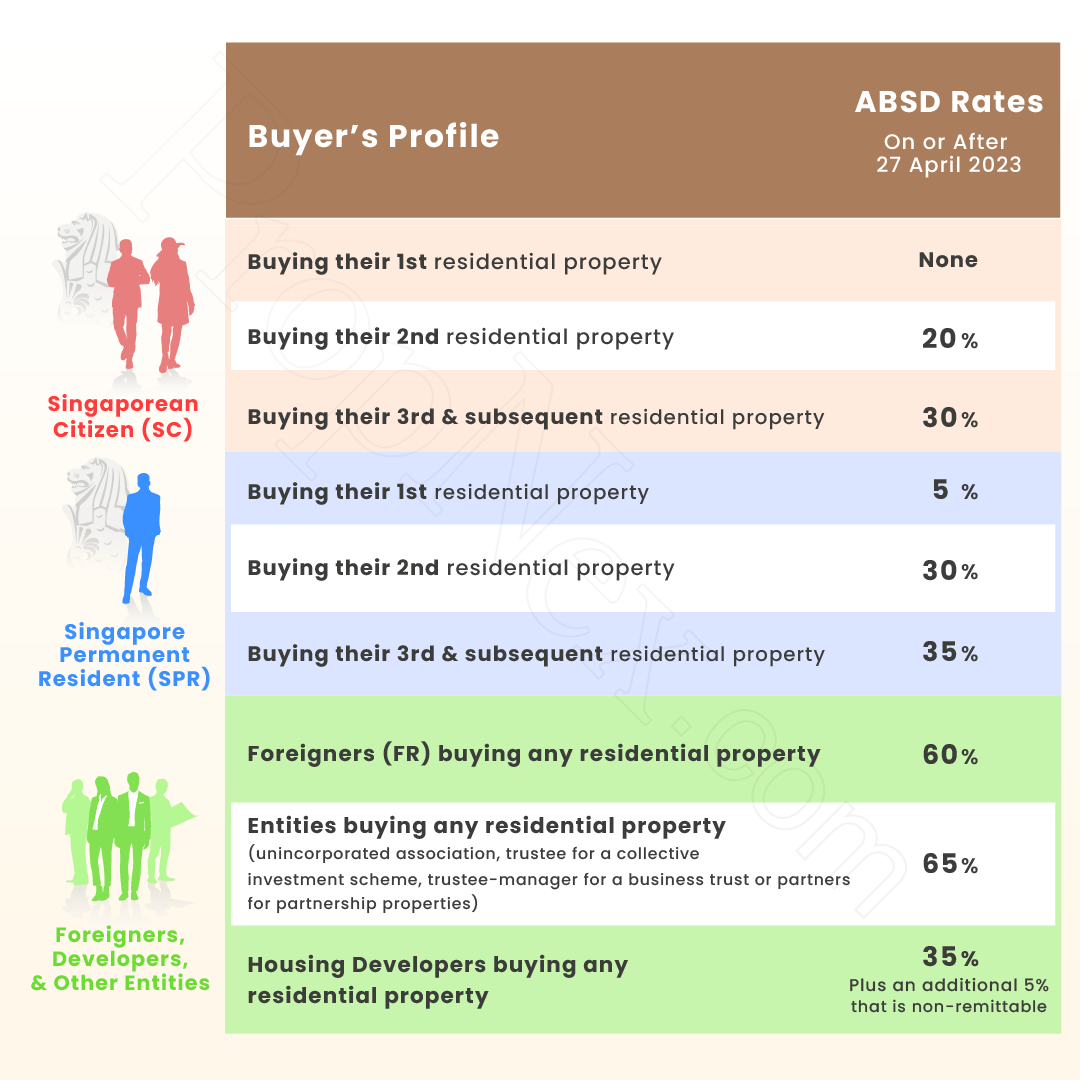

If you sell first, then buy, you don't need to pay ABSD since you're technically only holding one property at a time. But if you buy first, then sell, you'll need to pay ABSD upfront (20% if it's your second property as a Singaporean citizen, even higher for PRs or foreigners). Here are the full rates:

Fortunately, you can apply for a refund if, and only if, you sell your existing home within the 6-month deadline. Think of it as a grace period, if you will.

The thing is, life can throw you off sometimes. Maybe you found your dream unit before finding a buyer for your current place. Or you need a roof over your head in between. That's when sequencing mistakes can happen.

To illustrate the importance of sequencing, here are some examples:

You and your spouse have been thinking of upgrading for a while. Your current home, Condo A, is worth $1.2M. You've put it up for sale, but haven't quite found the right buyer. In the meantime, you keep an eye out for the upgrade unit.

Unexpectedly, you found Condo B. It's a new project in a good location. The price is $1.8M. But, there is only one unit left that is the size you're looking for, and there are two other couples eyeing it. Feeling the pressure, you decide to just buy Condo B even though you haven't sold Condo A.

Since you are a Singaporean Citizen buying your second property, you paid $360,000 in ABSD upfront, thinking you can get it refunded later on. But six months went by very quickly, and even though you already lowered the price for Condo A, you still couldn't find a buyer. Now the $360,000 is really gone.

Here's another example:

You and your spouse have been living in an HDB flat. You've completed the Minimum Occupancy Period (MOP) and are now thinking of upgrading. The flat is worth $650K, and your agent tells you there's an interested buyer.

You decided to proceed and sell your flat. But because you haven't had time to find a new unit yet, you and your family have nowhere to stay. So you decide to rent a 4-room HDB flat for you, your spouse, and children to live temporarily. The rent? $3,800 per month. You say it's only for six months, so that's $22,800 in total. You'll buy a new place before the six months are up.

Six months passed by, and you haven't found the right condo. Plus, prices have been climbing. It's just not the right time to buy. Maybe if you wait around, the prices will go down a bit? So you decide to rent for another six months.

But another six months have passed, and there is no sign that condo prices will come down any time soon. Units you were eyeing the year before are now worth at least $100K more. You've lost momentum and are now debating whether you should continue to rent as you wait for prices to calm down, or just go ahead and buy the condo.

Last one:

You and your spouse have a condo together. Suddenly, you find a bigger unit nearby that feels perfect for your growing family. It costs $1.7M. The urge to upgrade is strong.

But here's the problem: You're only four months away from the 3-year SSD period. If you sell now, you'll 'kena' 4% SSD on your sale price. On a $1.4M home, that's $56,000 gone. That's enough for a new kitchen cabinetry. Painful.

To avoid paying SSD, you think: maybe we buy the new place first, pay the ABSD, and then wait out the SSD. That leaves you only two months to find a buyer. If you fail to do so, you'll have to say goodbye to that $340K worth of ABSD. This will be excruciating!

These examples show how different scenarios can derail your property journey. And that's exactly why proper sequencing, aka timeline planning, matters. You can't be swayed by emotions or fomo. You need to weigh the pros and cons of your options because, in reality, it's not always so simple.

Selling first is generally safer, but you may risk losing your desired upgrade unit. You probably also need to find a temporary stay for your family. Buying first is riskier financially, but you can get your desired unit right then and there.

Instead of fighting your spouse because you've messed up your ABSD sequencing, follow these hot tips before you make your next move.

- Sort out your finances, whether it's planning cashflow or getting ready for a loan.

- List your current home the moment you start looking around. You can't expect everything to line up perfectly, but this gives you a better shot. So, you better plan that exit strategy.

- Know your project timelines. If you're buying new launches, don't forget to consider delays in TOP, as it may eat into your 6-month window.

- Factor in Hungry Ghost month. Like it or not, buyers get superstitious, and your home will sit unsold throughout the Hungry Ghost festival.

- Make sure you fully understand the extent and conditions of the remission. Really note down when your 6-month period begins. And don't treat refunds as guaranteed. If any condition fails, even something like a change in shareholding title, the refund may be denied. You can check out the full details here.

- Get professional guidance. When you feel clueless or helpless, it's best to consult with the pros and get good objective advice.

In theory, the six-month grace period seems like plenty of time, but in reality, property transactions don't always move on your schedule. Buyers get cold feet, banks take time, lawyers need to process paperwork, projects can delay their TOP, and yes, even the Hungry Ghost festival can affect you.

That's why ABSD sequencing is something that you need to consider carefully.

If you sell first, you avoid ABSD but may end up scrambling for a temporary stay. If you buy first, you secure your dream unit but take on the risk (and upfront cost) of ABSD. There's no one-size-fits-all answer, but what's certain is this: you need to go in with eyes wide open, a clear plan, and realistic timelines.

At the end of the day, upgrading should move you closer to financial freedom, not further from it. With the right sequencing, professional guidance, and a solid plan, you can avoid costly mistakes and focus on what really matters: finding the home that fits your family's next chapter.

And don't forget that you can always join us at our upcoming Property Wealth System (PWS) Masterclass to understand how to plan your next move confidently, from sequencing to portfolio growth.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.